If you are looking for a quick and easy way to get a loan in Nigeria, you may face some challenges. One of the most common requirements for applying for a loan in Nigeria is to provide your bank verification number. (BVN). It is a unique 11-digit number that gives you recognition in the banking industry in Nigeria. The Central Bank of Nigeria (CBN) has introduced BVN as a security measure to prevent and reduce illegal banking transactions.

However, not everyone has a BVN or wants to share it with online lenders. Some people may not have a bank account, while others may be concerned about the privacy and security of their BVN. Some loan apps may also use your BVN for fraudulent purposes, such as unauthorised deductions or identity theft.

Fortunately, there are some loan apps that allow you to borrow money without providing your BVN. These apps use other methods to verify your identity and credentials, such as your phone number, email address, social media accounts, etc. However, it is important to note that the loan app without BVN in Nigeria may also have some flaws, but even so, this app can prove to be a better option for those who need money immediately.

In this blog post, we will tell you about some of the Nigerian apps that can get you instant loans without BVN and how you can apply for them. You will know everything in detail, but for that, you need to read this blog post.

What is the BVN?

The Bank Verification Number (BVN) is a special 11-digit number that the Central Bank of Nigeria (CBN) gives to every bank customer in Nigeria. It started in 2014, and it uses biometric data like fingerprints and face pictures to stop illegal banking, fraud, and identity theft. When a bank customer registers for BVN, they have to give their biometric data and other important information that is stored in a central database that all banks in Nigeria can access. This common identification number makes it easy to track and monitor money transactions across different banks and financial institutions. It also makes the know-your-customer (KYC) process simpler.

The BVN also helps a lot in the loan application and approval process. Before giving a loan, banks and other financial institutions need to know who the borrower is, how good they are at paying back loans, and how much they can pay back. The BVN helps with this by giving a unique identification number that can be checked across the Nigerian banking industry.

Banks can use the BVN to see a customer’s financial history and check for any unpaid loans, defaults, or frauds. This information helps the banks decide how risky it is to lend money to a particular customer and make smart decisions on loan approval. Also, the BVN helps speed up the loan application process as the banks can quickly confirm the customer’s identity and financial history.

To sum up, the BVN is a common identification number for bank customers in Nigeria that helps to prevent fraud, increase transparency, and make the KYC process easier. It also helps in the loan application and approval process by helping banks check the creditworthiness of a customer and reduce the risk of lending money.

Nigeria’s Top 6 Loan Application : The Benefits of Loan Apps Without BVN

Loan apps without BVN are online platforms that offer quick and easy loans to people who do not have or do not want to share their Bank Verification Number (BVN). BVN is a unique 11-digit number that identifies every customer in the Nigerian banking system. It is used to prevent fraud and unauthorised transactions. However, some people may not have a BVN or may not trust some loan apps with their BVN due to security concerns. Therefore, loan apps without BVN can be a convenient option for them.

Some of the benefits of loan apps without BVN are:

Easy access to loans: Loan apps without BVN provide quick access to loans without the need for burdensome paperwork or protracted waiting periods. You can apply for a loan with just your phone number, bank account number, and personal details. You do not need to provide any collateral, guarantor, or income proof.

Quick disbursement: Loans from lending apps without BVN are frequently disbursed minutes after approval, making them perfect for urgent financial requirements. You can receive the loan amount directly into your bank account or through other payment methods such as cash pickup or a mobile wallet.

Flexible repayment: Loan apps without BVN offer flexible repayment options that suit your budget and cash flow. You can choose the loan amount, tenure, and interest rate that suit you best. You can also repay the loan in installments or in full at any time before the due date.

Low interest rates: Loan apps without BVN charge low interest rates compared to traditional lenders such as banks or microfinance institutions. The interest rates vary depending on the loan application, but they are usually between 1% and 4% per month. Some loan apps also offer discounts or incentives for early repayment or referrals.

Privacy protection: Loan apps without BVN protect your privacy by not requiring your BVN or other sensitive information. You do not have to worry about your BVN being misused or compromised by hackers or fraudsters. You also do not have to share your credit history or financial status with anyone.

Instant Top 6 Best Loan Application Without BVN in Nigeria’s Top 6 Loan Applicaion

1. FairMoney Loan App

FairMoney is a popular loan app that offers loans ranging from ₦1,500 to ₦500,000 with a repayment period of 4 to 26 weeks. The interest rates on loans from FairMoney range from 10% to 30%, depending on the loan amount and repayment period3. To apply for a loan from FairMoney, you need to download the app from Google Play Store and register with your phone number and email address. You also need to provide some personal and financial information, such as your name, date of birth, occupation, income, and bank account details. FairMoney will then assess your credit score and determine your eligibility and loan offer4.

2. JumiaOne Loan App

JumiaOne is a multi-purpose app that belongs to the Jumia Group, one of the leading e-commerce platforms in Africa. JumiaOne allows you to access various services, such as shopping, airtime, bills payment, and loans. JumiaOne offers loans ranging from ₦5,000 to ₦100,000 with tenors of 15 to 30 days, depending on your credit score5. To apply for a loan from JumiaOne, you need to download the app from Google Play Store or App Store and register with your phone number and email address. You also need to link your debit card or bank account to the app. JumiaOne will then verify your identity and credit history and approve your loan request within minutes.

3. CarrotPay (paylater) Loan App

CarrotPay is a loan app that provides loans for as low as ₦5,000 and as high as ₦50,000 with a repayment period of 60 to 180 days. The interest rates on loans from CarrotPay are typically 3% per month and never more than 10%. CarrotPay also uses a credit rating system to determine your eligibility and loan offer. To apply for a loan from CarrotPay, you need to download the app from Google Play Store and register with your phone number and email address. You also need to provide some personal and financial information, such as your name, gender, location, occupation, income, and bank account details. CarrotPay will then conduct an automatic verification and assessment of your profile and approve your loan within minutes.

4. Aella Credit loan App

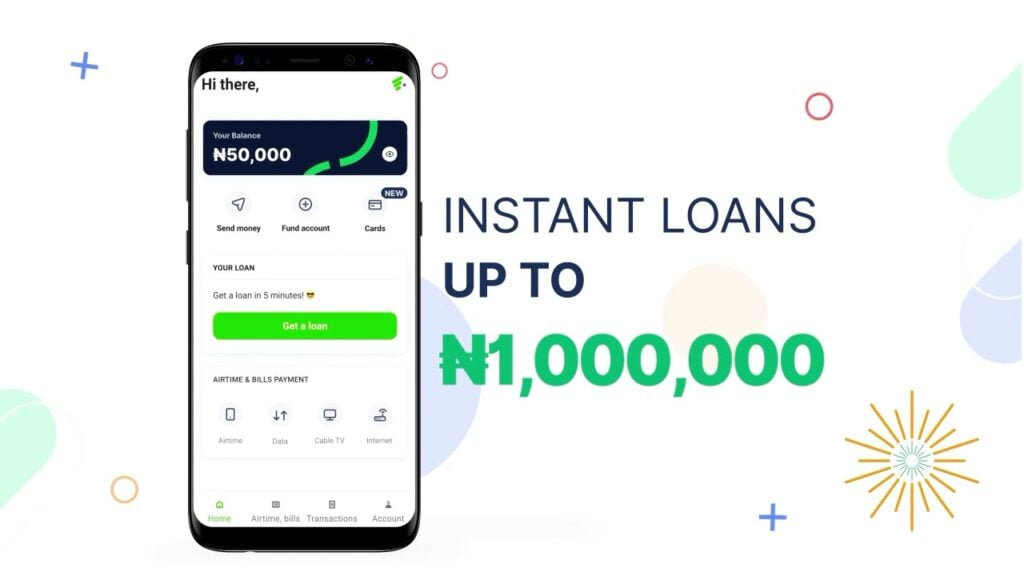

Aella Credit is a good place to get loans without BVN. You can borrow from N2,000 to N1,000,000 from this platform that cares about users. They don’t take long to give you the money. You can get it in 10 minutes after you apply. The interest rate is between 2% and 20% every month and the APR is between 22% and 264% every year.

A friend of mine told me how Aella Credit helped them. They needed money for a medical emergency and they didn’t have enough savings. They got a loan from Aella Credit and they liked the clear and fair conditions and rates. The app’s customer service was helpful and fast. They got the money they needed and they could pay for the medical treatment for their family. Aella Credit was a great help for them.

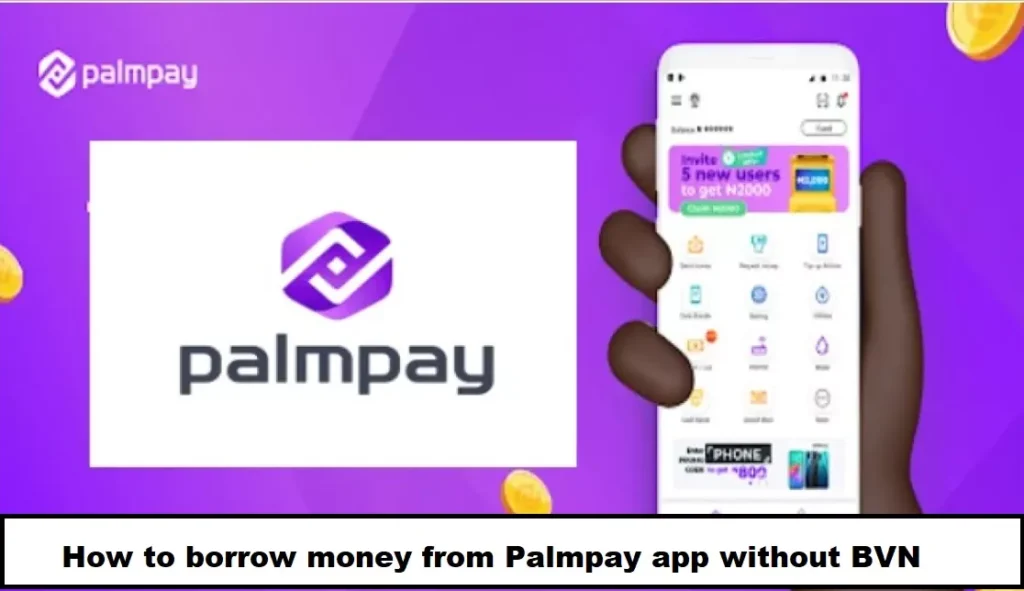

5. Palmpay Loan App

PalmPay Loan app is a trustworthy app that gives you loans fast. You can get a loan in 5 minutes after they approve you. You don’t need to show any documents or assets before you borrow money. That makes it very easy to use. If you are a new customer, you can borrow up to 10,000 from them.

My relative needed money urgently for his mother’s health problem. He could not get money from anyone else until he found out about PalmPay app. He got the money he needed and paid the medical bills. It was quick and easy. The interest rate for a PalmPay loan is from 15% to 30%. It changes based on how much money you borrow and how good your credit is.

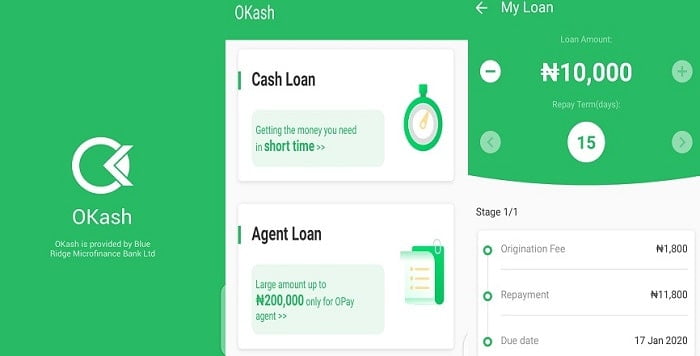

6. Okash Loan App

OKash loan app is a reliable and popular option to get loans. You can access this platform through the Opay mobile app, which is run by Opay Digital Services Limited/Paycom. However, OKash is owned and operated by Blue Ridge Microfinance Bank Ltd. only. The interest rate for this app is about 36.5%.

A friend of mine had a sudden problem when their refrigerator broke down. They needed money quickly to buy a new one. They heard about the OKash Loan App from a coworker and decided to try it. The app was easy to use and approved their loan fast. They got the loan amount in their account soon, and they could buy a new refrigerator without any more trouble.

How to Choose the Best Loan App Without BVN in Nigeria

Before you apply for a loan from any of the apps mentioned above, you need to consider some factors that will help you choose the best option for your needs. To assist you, consider the following advice:

Compare the interest rates: Different loan apps have different interest rates that affect how much you will pay back in total. You should compare the interest rates of various loan apps and choose the one that offers the lowest rate for the amount and duration of your loan.

Check the repayment terms: Different loan apps have different repayment terms that affect how flexible and convenient it is for you to pay back your loan. You should check the repayment terms of various loan apps and choose the one that suits your income and cash flow. For example, some apps may allow you to repay your loan in installments or extend your due date if you encounter any difficulty.

Read the reviews: One of the best ways to find out about the reliability and reputation of any loan app is to read the reviews from other users who have used it before. You should read the reviews of various loan apps and see what they say about their customer service, loan processing, and repayment experience. You should also look out for any complaints or issues that may affect your decision.

Conclusion

Getting a loan without BVN in Nigeria is possible if you use the right loan app. However, you need to be careful and responsible when borrowing money online. You should only borrow what you need and can afford to repay on time. You should also avoid giving out your BVN or other sensitive information to any loan app that you are not sure of. By following these tips, you can get a loan without BVN in Nigeria and solve your financial problems.

FAQs About Loan Apps Without BVN in Nigeria

Q1. How can I trust these loan apps without BVN?

A. Trust is essential when dealing with financial matters. These apps prioritize security and employ encryption to protect your data. Additionally, user reviews and ratings can help you choose a reliable app.

Q2. Can I apply for a loan without a job?

A. Yes, some loan apps without BVN in Nigeria offer loans to unemployed individuals. They assess your ability to repay through alternative means, such as your financial history.

Q3. Are the interest rates reasonable?

Interest rates vary between apps, so it’s essential to compare options. Some apps offer competitive rates, while others may have higher fees. Always make sure to read the terms and conditions completely.

Q4. Is there a risk of defaulting on these loans?

A. Defaulting on any loan can have consequences. Loan apps without BVN will typically have measures in place to recover their funds, such as reporting to credit bureaus or using collection agencies.

Q5. Can I apply for multiple loans simultaneously?

A. Yes, but be cautious. Applying for multiple loans at once can affect your credit score negatively. It’s advisable to evaluate your needs and financial capacity before applying for loans.

Q6. What happens if I’m unable to pay back the loan on time?

A. If you face difficulties repaying the loan on time, contact the app’s customer support immediately. They might provide extensions or different repayment options.